Skrill debit card application and verification step by step

Skrill has been a fast and reliable payment partner for experienced sports bettors for 20 years. Enjoy the benefits for yourself!

👉 What is Skrill?

Skrill is one of the most popular and well-known digital (online) wallets with tens of millions of users around the world. Skrill allows you to make secure and low cost online payments, transfer money to others or store your money online. You can also request an embossed contactless Mastercard or Visa debit card for your Skrill account after registering. For a fee of just €10. However, this is not a necessary condition to move your money.

You can use your Skrill debit card to make online and traditional payments and withdraw cash from ATMs. It’s mean effectively replacing your traditional debit card. All you need to set up a Skrill account is an email address.

You can top up your Skrill wallet balance with a simple bank transfer, but it’s important to note that you can also have your account in several different currencies. This will save you a lot of conversion costs in the long run.

Most online betting shops and websites will ask for your personal details when you make a purchase. Which you may be reluctant to share with third parties for understandable reasons.

Here comes the time for your Skrill wallet. You need to verify your identity to Skrill once if you want to use your wallet online. After which the two sides will communicate the details of most transactions, saving you a lot of time and headache.

How to authenticate your Skrill account step by step

👉To be able to increase your withdrawal and deposit limits or order a physical debit card. Nnot to mention increase your security level, you should authenticate your Skrill account!

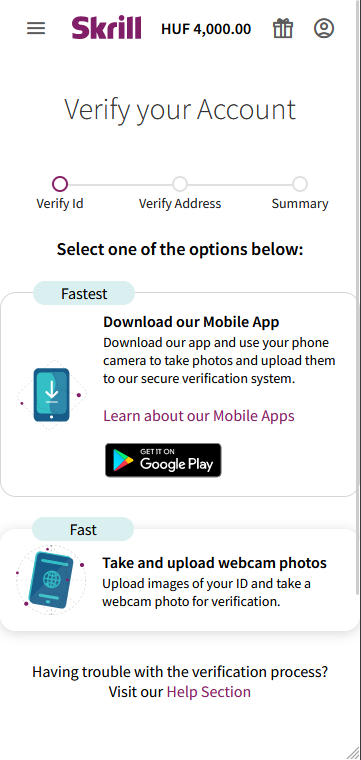

👉You can choose the authentication method yourself! The quickest way to verify your account is through the app, as you can take a photo of yourself within the app, which will be uploaded to your account instantly. You can also opt for a more traditional solution, in which case you’ll need to upload a high-quality scanned image of both sides of your ID card or driving licence to your account.

👉Then you only need to prove your address, which requires a paper document no more than three months old showing your name and address (e.g. bank account, utility bill)

👉Skrill will notify you by email if the identification process is successful. It’s important to note that you can use your Skrill wallet for withdrawals and deposits without the confirmation email, but we strongly recommend that you verify yourself as this will make your wallet more secure and you will also gain more privileges, e.g. you will be entitled to higher deposit limits!

How to apply for a Skrill card step by step

👉After completing the above steps (Skrill registration, top up your balance, authenticate your account) you can apply for a Skrill debit card – Skrill prepaid embossed contactless mastercard.

👉To apply for a Skrill card, you need to verify your account (see previous section).

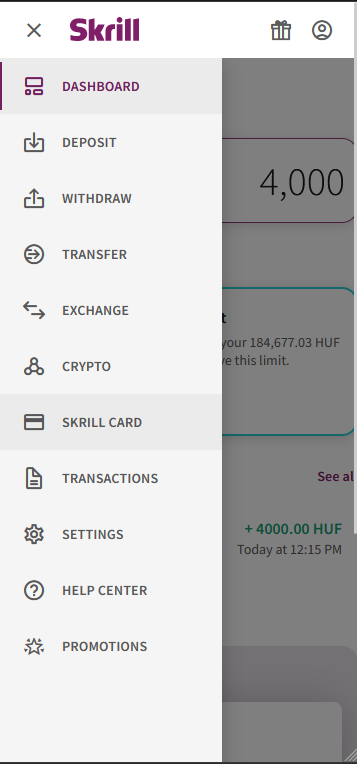

👉Go to ‘SKRILL CARD’ in the main menu and select ‘Physical’.

👉It’s a debit card that, like a traditional debit card linked to a bank account, is directly linked to your Skrill account, allowing you to make transactions and payments online. You can use it for both non-online purchases and cash withdrawals!

👉Applying for a Skrill card costs the equivalent of EUR 10 per year, which Skrill will automatically deduct from your balance! There is no separate account management fee for your account

👉You will receive the PIN code for your Skrill debit card after you activate your card in your Skrill account under ‘Skrill Card’.

👉Experience has shown that it takes approximately two weeks for the physical card to arrive at your address by post.

👉Costs associated with using your Skrill debit card (the information provided here is for information purposes only and is subject to change at the time of publication):

- Shopping in shops online and offline: free

- Receive money online and offline

- Online account history: free

- Change PIN code: free

- Online banking: 3.99%

- Cash withdrawal: 1.75%

- Skrill card annual fee: €10

- Lost/stolen card replacement: €10

English

English